Charlie, a personal finance app that began as a chatbot, is relaunching today with a revamped experience focused on the larger goal of helping everyday Americans get out of debt. To do so, Charlie presents users with a full picture of their current debt and how long it will take them to pay it off. Users then connect their bank account to Charlie for personalized assistance in reducing their bills. It also “gamifies” saving money to make the process of setting money aside for paying down debt more fun.

According to Charlie CEO Ilian Georgiev, the idea to turn saving into more of a game arose from his prior experience in the mobile gaming industry. At a company called Pocket Gems, he helped scale apps that generated millions of dollars in revenue growth from across millions of users.

CEO and co-founder Ilian Georgiev. Image Credits: Charlie

“A really well-designed mobile game gets people to obsessively manage a virtual economy,” he explains. “And what I was curious about was how do we get people to do better in the real-world economy by using the same kind of tools?”

To help on that front, Charlie’s team includes people with backgrounds in not only computer science and engineering, but also in psychology. Using similar psychological tricks as found in gaming — rules, progress bars and reward mechanisms — the app helps nudge its users toward saving.

The original version of the Charlie app, launched in 2016, worked a little differently, however. It would analyze transaction data to look for areas where the user could improve their finances. It also worked over texting and through Facebook Messenger — platforms Charlie adopted with the idea that users needed a simpler way to connect with their finances.

“But the thing that we kept hearing over and over again, both qualitatively and quantitatively, is that the biggest concern that our users had is, ‘How do I get out of debt?’ So then we said, instead of casting this really wide net … let’s laser focus on this one particular problem,” says Georgiev.

Today, the chatbot still lives on as a feature inside the new Charlie app, but it’s not the core experience.

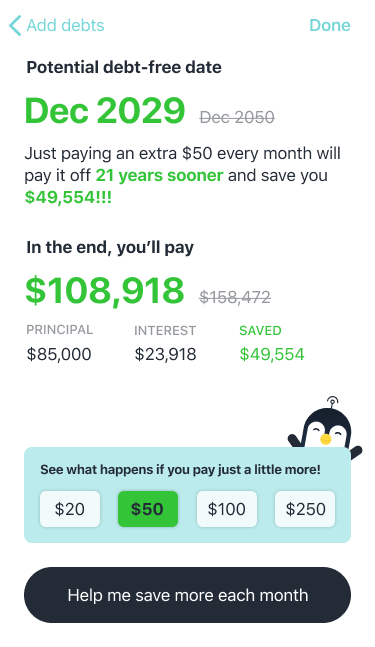

Image Credits: Charlie

Instead, users begin by providing the app with information about their debt. Georgiev stresses that many Americans often know their debt down to the penny — whether that’s how much they have left on student loans, how much left on their car, how much credit card debt they have and so on.

The app then calculates how long it would take to pay off this debt if you only made minimum payments. This number helps shock people into action, as they’ll often discover they’re going to be in debt for another 40 or 50 years.

“For most users, that’s an epiphany because they’ve never seen these numbers before, and the math required — even if you do it in Excel — the math required to figure that out is beyond most people,” Georgiev says.

Image Credits: Charlie

The app then encourages users to learn how they can reduce the time it would take them to get out of debt by paying more than the minimums. By clicking a button, they can visualize the what happens if you pay, for example, $20 or $50 more per month.

The final step is to help users find that extra cash. In part, this may come from savings the app locates on users’ behalf. But it also comes from the money-saving “game.”

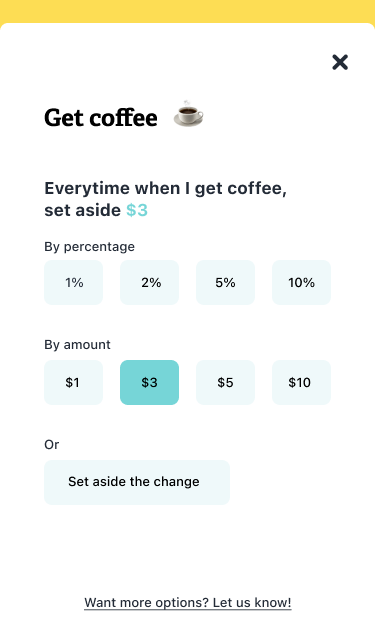

Charlie helps users create autosave rules which, when applied, auto-transfer money from the user’s connected bank account to Charlie’s digital wallet (an account held at partner bank, Evolve). These can be fun rules or even sort of ridiculous ones. For example, you could create “Guilty Pleasures” rules where Charlie will put away 10% every time you eat McDonalds, or it could save $1 for you every time a contestant on “The Bachelor” says they’re “here for the right reasons.”

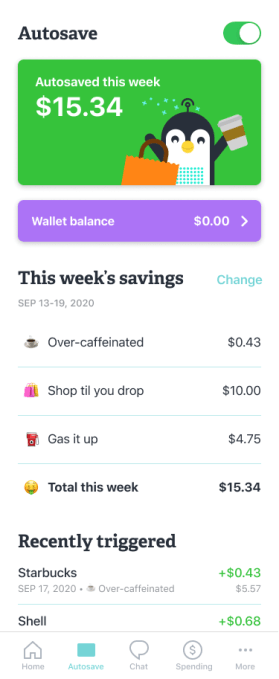

Image Credits: Charlie

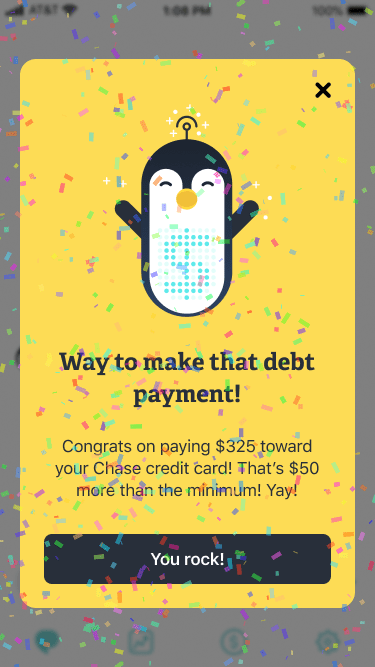

As those rules apply, money is saved and a little progress bar fills. The app rewards you with rainbow confetti as you achieve, also similar to some mobile gaming experiences.

At the end of the month, the user can take that saved money to make a larger payment toward their debt. Currently, Charlie doesn’t manage the bill pay aspects itself — which is a limitation. You have to transfer the funds back to your bank. But a bill pay feature is due to arrive in a couple months we’re told.

Later this year, Charlie plans to offer debt refinancing services to users. In this case, the team believes they can give the users lower interest rates because Charlie users will have proven, through their use of the app, that they’re lower risk.

Image Credits: Charlie

Further down the road, Charlie aims to move more into neobank territory by issuing a debit card to users that works with users’ Charlie account. To differentiate from the growing number of neobanks, Charlie will continue to focus on paying down debt and savings.

Georgiev notes that the app’s business model is not built around user data collection, however. Data that’s ingested is sanitized and encrypted, and the app has a strict privacy policy. Plus, Charlie mainly helps people save money, but those funds are actually stored with a partner bank, not in Charlie itself. And because it’s involved in the act of moving money, it has to adhere to regulations around security and fraud prevention.

Today, Charlie charges a $4.99 per month subscription, which the company aims to make up for by helping people reduce their larger debt loads more quickly. However, even that small amount could give money-sensitive users pause, despite Charlie’s perks and successes.

To date, Charlie has registered a half million users for its older chatbot experience. It hopes to now grow that figure with its new tools.

The app is available on iOS and Android.