I have worked in startups for more than half of my life, and for most of that time, I was the only Black person in the room. As a result, the lack of representation in tech isn’t abstract to me.

Besides my experience, I read and talk about diversity in tech every day, so when I was offered a chance to speak to three founders from underrepresented groups at TechCrunch Disrupt, I was eager for the opportunity.

I was joined by Hana Mohan, a transgender woman who is the CEO and co-founder of MagicBell; Leslie Feinzaig, a Latina entrepreneur who started the Female Founders Alliance; and Stephen Bailey, a Black man who is the founder and CEO of ExecOnline, an online leadership development platform.

Full TechCrunch+ articles are only available to members.

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription.

Every entrepreneur swims against a current, but these founders face challenges that their white, male counterparts do not.

Each of them has cracked the code that grants access to capital and influential social networks, but I also wanted to learn about how they approached leadership and management, hear some of their strategies for building confidence and find out whether generic best practices for startup success applied to their lived experiences.

Thanks again to the panelists who joined me. We went slightly over our allotted time, but it was a candid discussion that uncovered some unique perspectives. I picked out some of the highlights for the recap, but there’s a video that captures the entire chat.

Have a great week, and thanks for reading TechCrunch+!

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

Where and when to spend your recently raised dollars

Image Credits: PM Images / Getty Images

Startups have lots of options when it comes to fundraising, with “ample capital, a focus on distributed investing [and] more first-check investors than ever before,” Natasha Mascarenhas writes.

At TechCrunch Disrupt, Harlem Capital’s Henri Pierre-Jacques and BBG Ventures’ Nisha Dua explained how founders should allocate recently raised dollars in today’s environment.

“It’s easier to raise and harder to spend these days, because there’s such a high demand for talent,” Dua said. “The answer for where to spend is going to be different for every company across many different industries.”

Battery chemistry company Sila’s founder Gene Berdichevsky on the science of scaling up

Image Credits: Bryce Durbin

As part of an ongoing series of interviews with founders of transportation companies, Rebecca Bellan spoke to Sila Nano founder Gene Berdichevsky about his company’s efforts to build and scale the next generation of EV batteries.

“We want to be a world leader and do for the energy storage industry what Intel did for the personal computing industry,” he said.

“Intel didn’t make every single chip or the motherboards or the PCs. They made the most important components whose performance drove the adoption of the devices people actually wanted, and the better the microprocessor got, the better computers got, the more people used them and the more the world changed.”

What you should know about working with corporate venture investment committees

Image Credits: syolacan (opens in a new window) / Getty Images

Most founders are exclusively focused on getting a check from a private VC firm, but in the first half of this year, corporate venture capital funding totaled $79 billion across 2,099 deals globally.

In a guest post for TechCrunch+, WIND Ventures’ Brian Walsh explains key differences between CVC and VC and shares his basic best practices for getting a “yes” out of a corporate investment committee.

It’s a different environment, but there are “great opportunities with this growing investor set,” he writes.

“By understanding the roles, processes and how to help get their deal through a CVC IC, all parties stand to benefit.”

Evil Geniuses CEO on the path toward esports ubiquity

Image Credits: John McCoy / Getty Images

The esports league Evil Geniuses (EG) was founded in 1999, but at TechCrunch Disrupt, CEO Nicole LaPointe Jameson told Lucas Matney that the industry is still in its infancy.

“Today, it’s a bit of a dance to bridge the understanding for some of the older generations that have negative perceptions of what gaming is, which often aren’t factually correct,” she said.

“I am a complete optimist around the younger generations — I don’t believe esports will be perceived as a niche sport for younger audiences.”

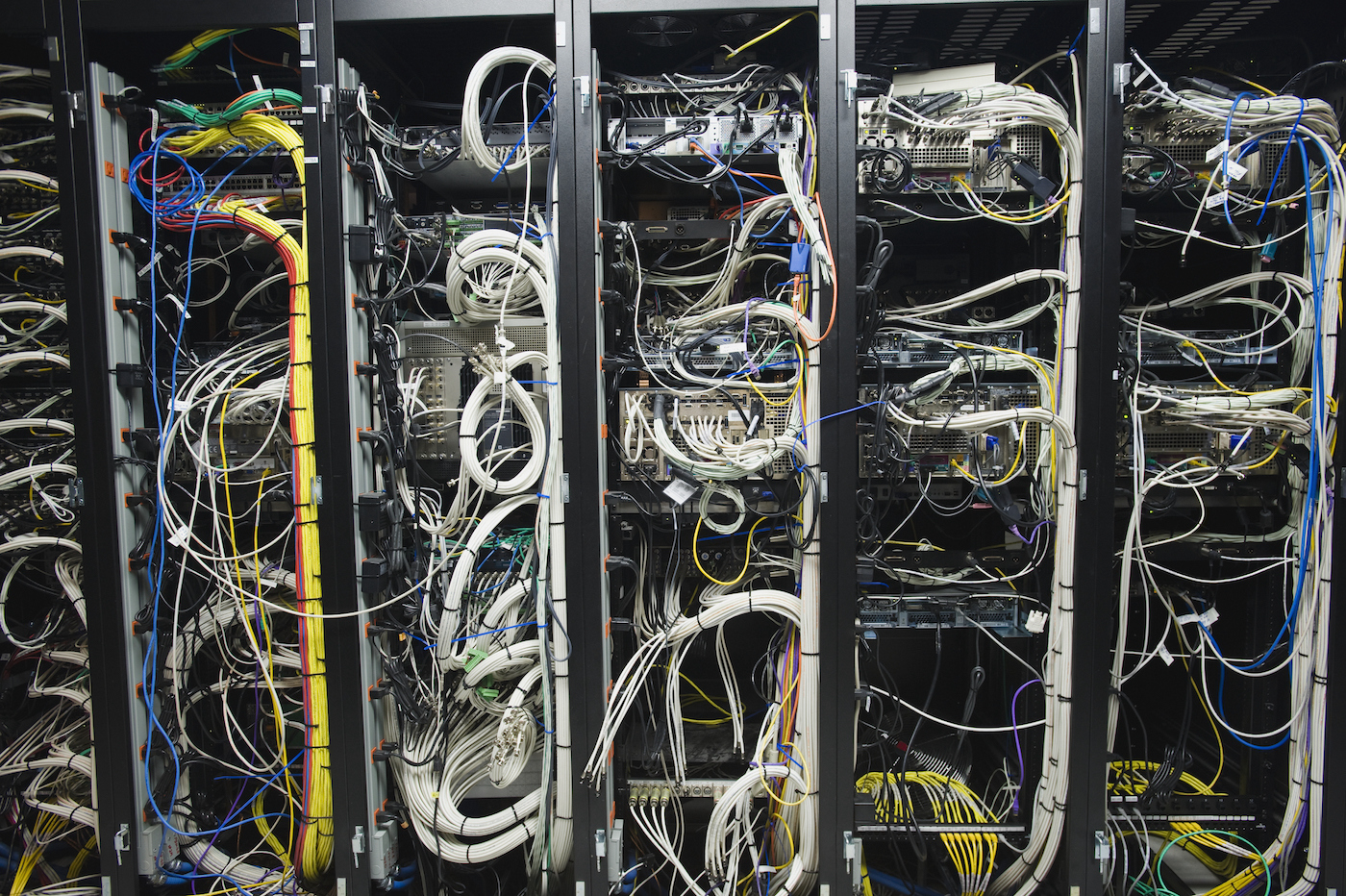

Image Credits: Erik Isakson (opens in a new window) / Getty Images

“Infrastructure as code (IaC) has been gaining wider adoption among DevOps teams in recent years, but the complexities of data center configuration and management continue to create problems — and opportunities,” Karan Bhasin writes.

He surveyed top investors in IaC startups to find out more:

- Sheila Gulati, managing director, Tola Capital

- S. Somasegar, managing director, Madrona Venture Group

- Aaron Jacobson, partner, New Enterprise Associates

- Sri Pangulur, partner, Tribe Capital

- Teddie Wardi, managing director, Insight Partners

- Tim Tully, partner, Menlo Ventures

Informatica’s IPO will test public markets’ appetite for slower-growing tech offerings

Image Credits: matejmo / Getty Images

Six years after a PE firm took it private, Informatica filed to go public last week at a valuation reportedly as high as $10 billion.

“A number that big demands exploration,” declared Alex Wilhelm, who pored over the S-1 with great interest yesterday afternoon.

“If investors can get to a point where they consider that the company’s subscription revenues are set for long-term growth, a 7x multiple doesn’t seem too wild,” he writes.

Index, Sequoia and Canvas investors weigh in on how to raise your first dollars

Image Credits: RapidEye (opens in a new window) / Getty Images

“Founders seeking to raise their first round of capital may feel overwhelmed by the prospect,” Mary Ann Azevedo writes. “There is definitely plenty of capital out there, but there are also a lot of startups clamoring for it.”

At TechCrunch Disrupt, three investors unpacked this dilemma, sharing insider tips that will help entrepreneurs clarify their thinking, forge closer partnerships with investors and reset their expectations.

- Nina Achadijan, partner, Index Ventures

- Rebecca Lynn, co-founder and general partner, Canvas Ventures

- Luciana Lixandru, partner, Sequoia Capital

As Apple messes with attribution, what does growth marketing look like in 2021?

Image Credits: NurPhoto (opens in a new window) / Getty Images

Apple rolled out app tracking transparency in April, giving users the ability to stop their phones from sharing data about their behavior.

More recently, changes in iOS 15 permitted consumers to opt into mail privacy protection and exert additional control over app permissions.

This is all great news for privacy-minded consumers, but for startups that live and die by their ability to measure growth and engagement, there’s confusion and uncertainty.

To learn more about how growth marketers are recalibrating data collection, Managing Editor Danny Crichton interviewed three experts at TechCrunch Disrupt:

- Jenifer Ho, VP marketing, Elation Health

- Shoji Ueki, head of marketing and analytics, Point

- Nik Sharma, owner, Sharma Brands

Why and when startups should look to diverse sources of capital

Image Credits: Hill Street Studios (opens in a new window) / Getty Images

Is chasing venture capital the right choice for your startup, or are you doing it because it’s what’s expected?

“Venture capital is a popular source of capital for early-stage startups, but it’s definitely not the only one,” Mary Ann Azevedo writes. “Debt is an increasingly popular alternative, as is non-dilutive, revenue-based financing.”

She spoke with three experts at TechCrunch Disrupt to discuss the various ways companies can raise capital and which might be the best avenue for startups:

- Arun Mathew, partner, Accel

- Michele Romanow, co-founder and president, Clearco

- Harry Hurst, co-founder and co-CEO, Pipe

“We’re very bullish about some of the categories that haven’t traditionally got as much funding,” said Romanow. “We just think that you should think about what you’re spending the money for, and maybe use cheaper capital for those repeatable expenses.”

Chamath Palihapitiya speaks to SPAC concerns, from fees to disclosures to quality

Image Credits: Michael Kovac / Getty Images

Investor Chamath Palihapitiya has formed at least 10 special purpose acquisition companies so far: The New Yorker dubbed him the “Pied Piper of SPACs,” while Bloomberg crowned him “King of SPACs.”

Connie Loizos spoke to him at TechCrunch Disrupt about some of the downsides of SPAC financing that have given concern to many, such as corporate disclosures. “I think the big concern with SPACs is there’s a lot of pixie dust,” she said.

Palihapitiya’s response:

If you look at social media, there was Facebook, and then there [were] a bunch of other crappy social networks that went out of business. I think SPAC sponsorship will look the same way. I think there will be a handful of groups that prove consistently through their actions that they are doing a great job for investors, for disclosure, for regulators [and] for these companies…

7 takeaways from Rivian’s IPO filing

Image Credits: Kirsten Korosec

Transportation Editor Kirsten Korosec and Alex Wilhelm reviewed the IPO for electric vehicle company Rivian and shared seven takeaways.

Building an EV company is costly; so far the company has raised nearly $11 billion and employs around 8,000 people. And it’s just getting started.

Kirsten and Alex reviewed Rivian’s operating results going back to 2019 and found much to discuss — everything except revenue, that is.

It doesn’t exist because Rivian has essentially zero historical revenues to report; that of course makes sense because Rivian is just starting to deliver the first R1T trucks (revenue yay!) to customers. You can spy a dribble of income in the interest section, but that’s effectively it; Rivian has only made money thus far from simply having lots of cash, some of which generated a paltry return.

The first win: Getting early customers to take a chance with you

Image Credits: mikkelwilliam (opens in a new window) / Getty Images

There’s a reason why business owners frame the first dollar they earn: It recognizes their own effort, but it also pays tribute to the customer who decided to give them a chance.

“You may be looking ahead to raising some funds and trying to juggle the administrative aspects of running a business, but before all that, the purpose of your company is to sell your solution and generate revenue,” writes Ron Miller.

“But to do that requires customers, so how do you get someone to take a chance with you?”

To answer that question, he interviewed three industry veterans at TechCrunch Disrupt:

- Kate Taylor, head of customer experience, Notion

- Pablo Viguera, co-CEO and co-founder, Belvo

- Vineet Jain, CEO and co-founder, Egnyte

Reid Hoffman on the evolution of ‘blitzscaling’ amid the pandemic

Image Credits: Kelly Sullivan/Getty Images for LinkedIn

Like many buzzwords in tech circles, “blitzscaling” has taken on a life of its own since it was coined by Greylock partner and LinkedIn co-founder Reid Hoffman.

“Blitzscaling itself isn’t the goal,” he clarified during TechCrunch Disrupt.

“Blitzscaling is being inefficient; it’s spending capital inefficiently and hiring inefficiently; it’s being uncertain about your business model; and those are not good things.”

What a community means in the modern world of startups

Image Credits: enviromantic (opens in a new window) / Getty Images

When I worked as a community manager, it quickly became apparent that each company I worked at had different ideas about what “community” meant.

Is it a function of customer service? Marketing? Should product teams work to promote it? What’s the best way to measure it?

“What, precisely, do we mean when we use the word ‘community’ in the world of startups?” Brian Heater asked the members of his TechCrunch Disrupt panel:

- Alex Angel, chief community officer, Commsor

- Lolita Taub, corporate Development VP at Catalyte, co-founder and general partner, The Community Fund

- Katelin Holloway, 776 founding partner

Who needs a BaaS partner, anyway?

Image Credits: Klaus Vedfelt (opens in a new window) / Getty Images

Banking-as-a-service (BaaS) startups tap into banking infrastructure, which makes it easier for developers to create tools that facilitate payments and transfers. As Ryan Lawler noted recently, it’s never been easier to offer your own credit card.

To get a better understanding of the problem BaaS providers are trying to solve, Ryan spoke with several founders in this space, including:

- Unit CEO Itai Damti

- Bond CEO Roy Ng

- Synctera CEO Peter Hazlehurst

“Unless you’re super deep in financial services already, the time and effort required to figure it out yourself is not worth it and you will never get a great deal,” Hazlehurst said.